tax on unrealized gains uk

Calculate gain or loss on exchange. Last reviewed - 30 December 2021.

How To Tax Capital Without Hurting Investment The Economist

VAT Amount will be paid to tax admin as KHR.

. There will be a corresponding debtor relationship where the debtor to the creditor loan relationship is within the charge to UK corporation tax and is required to bring into account the exchange gains and losses for tax. By example consider the owner of a large S corporation worth 200 million. However it was my understanding that unrealised gains of this nature should be stripped out of the calculation for Corporation Tax.

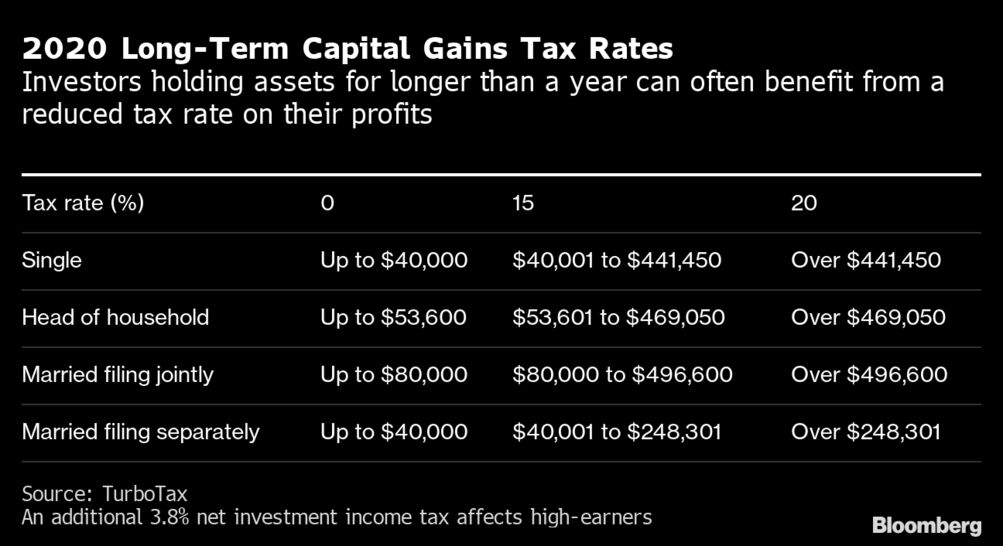

You buy 200 worth of goods from the USA on 30 days credit so you have an expense in your accounts of 100 because at the. Tax on unrealized gains uk Monday February 21 2022 Edit If youre a basic rate taxpayer you have t o pay 10 on your gains on normal assets but you have to pay 18 on the property as CGT. If you are in the 15 tax bracket for the State of California your capital gains tax rates are as follows.

A further complexity arises in the UK as tax is calculated on an individual entity basis. Law360 October 25 2021 534 PM EDT -- New levies on the earnings and unrealized capital gains of wealthy individuals have emerged as. EXIT TAX According to the draft Amendment the tax on income from unrealised gains should be understood as the taxation of capital gains unrealised due to the transfer of assets by a taxpayer to another state without a change of the owner of the assets.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized capital gains but unrealized capital gains. This is a very big deal. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving much-needed capital.

It mean that you lose 247 20247 200. The accounts will also show unrealised gains or losses where such assets or liabilities exist at the end of the period of account and are retranslated into sterling at the closing rate see BIM39510. Specifically these individuals would pay a tax rate of at least 20 on their full income or the combination of any wage income and unrealized gains.

Lets look at an example and for ease lets say that GBP 1 is worth US 2. Under FRS102 we need to show the investments at market value at year end which is easy to do as they are publicly traded shares. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

A tax on unrealized gains would harm the economy. The way its currently structured the tax would affect the richest 700 Americans forcing them to include unrealized gains as part of their annual income. Below are one economists estimates of what the top 10 wealthiest Americans would.

President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of. Its the gain you make thats taxed not the. The result is an unrealised gain of roughly 30000.

The competition is looking to track and report any transaction over 600 trying to normalize taxes on unrealized gains and doesnt understand that companies will raise prices if they have more. I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to 15k. A UK resident company is taxed on its worldwide total profits.

According to the ATAD Directive the tax levied on unrealized capital gains is intended to ensure that if a taxpayer moves assets or its tax residence out of the tax jurisdiction of a state that state is allowed to tax the economic value of any capital gain created in its territory even though that gain has not yet been realized at the time of the exit. Gifts of appreciated assets resulting in unrealized gains that are received during life and held at death will be treated for tax purposes as realization events These gains will be taxed the same way as if they were sold. In simple terms a foreign exchange gain or loss is realised when a transaction is finalised and unrealised whilst it is still in progress.

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. This means that tax liabilities can arise from exchange gains which are unrealised and so are unfunded. This owner employs hundreds of workers and the business is the economic cornerstone of a small community.

18 in so far as the gain sits in your basic rate band ie if your earnings are under 50000 the remainder of the basic rate band 28 on everything if you are a higher rate taxpayer or on the balance if some was taxed at 18. A single taxpayer may exclude 5 million from their lifetime tax liability for unrealized gains from the. The EU Anti-Tax Avoidance Directive 20161164 the ATAD into the Polish legal system.

The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as they accrue. Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. Therefore the rules should only apply to a lender where amounts are being lent to a non-UK resident overseas company.

Unrealised gains on investment shares - is Corp tax chargeable. It is realized or unrealized gain or loss on exchange rate. This reflects the 10k investment and the 5k unrealised gain.

It is realized loss on exchange rate. Our problem comes with regards to Corporation tax - my gut says that as the gains are unrealised there can not be a. The main sources of income are i profits of a.

VAT amount will be paid to tax admin 200 x 4100 KHR 820000. Corporate - Income determination. Total profits are the aggregate of i the companys net income from each source and ii the companys net chargeable gains arising from the sale of capital assets.

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

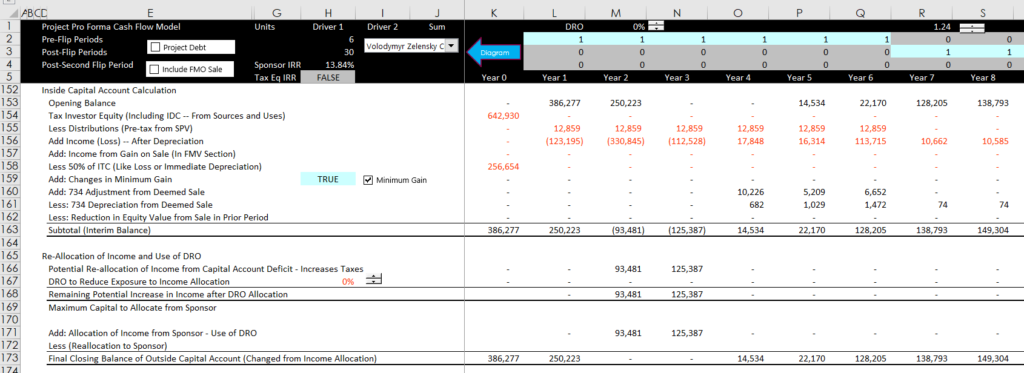

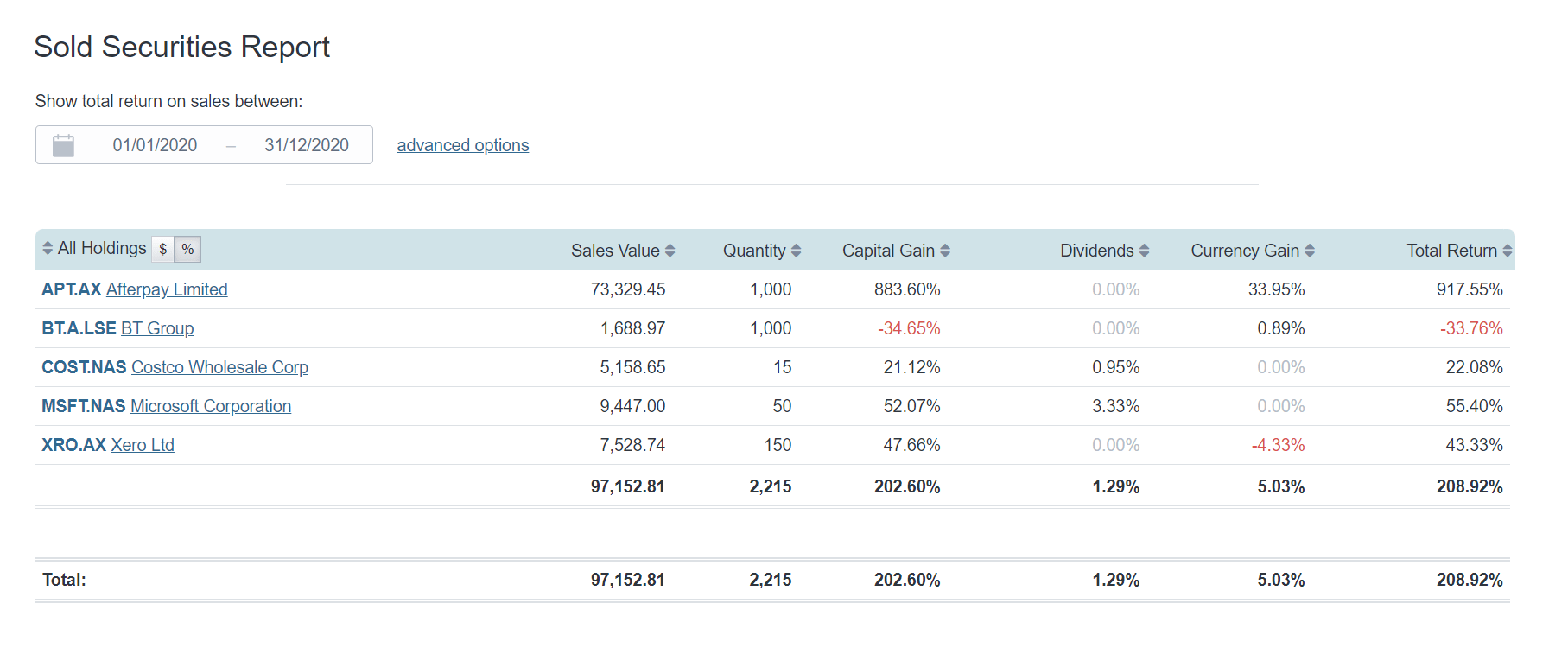

Inside Capital Account 704 B Edward Bodmer Project And Corporate Finance

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

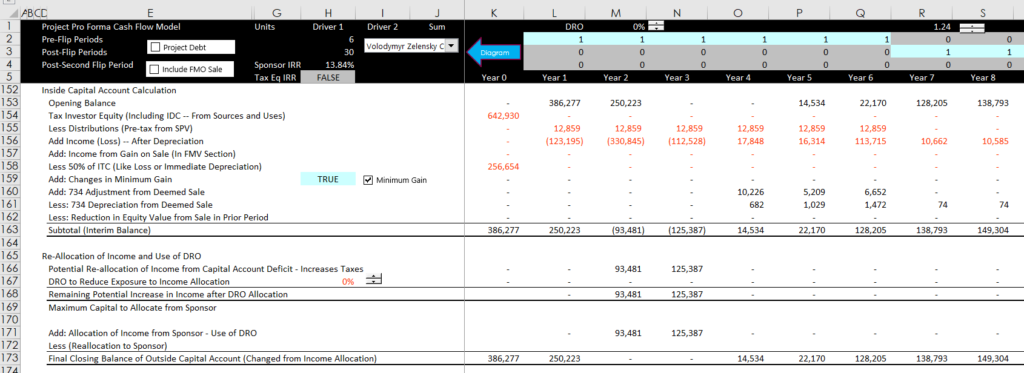

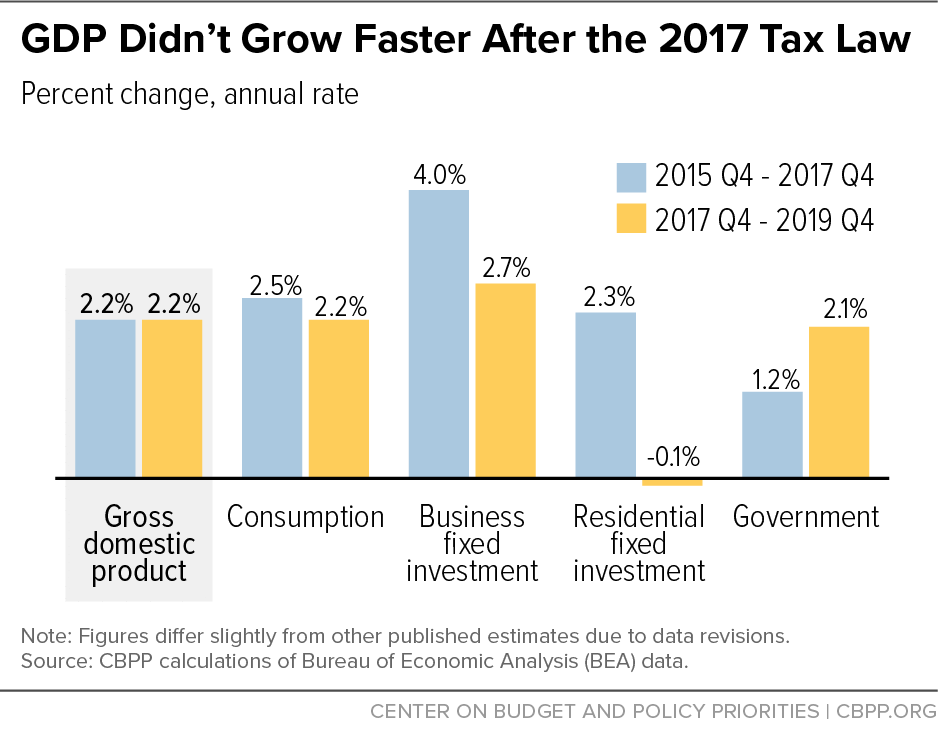

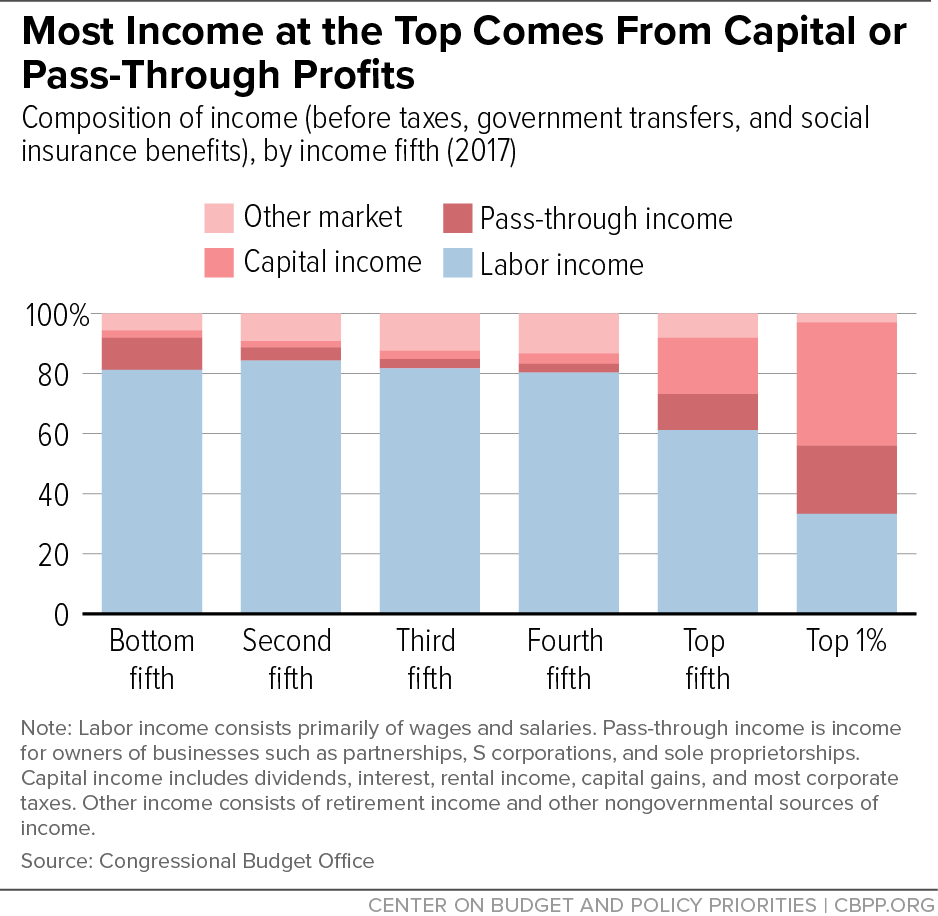

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

Tax Advantages For Donor Advised Funds Nptrust

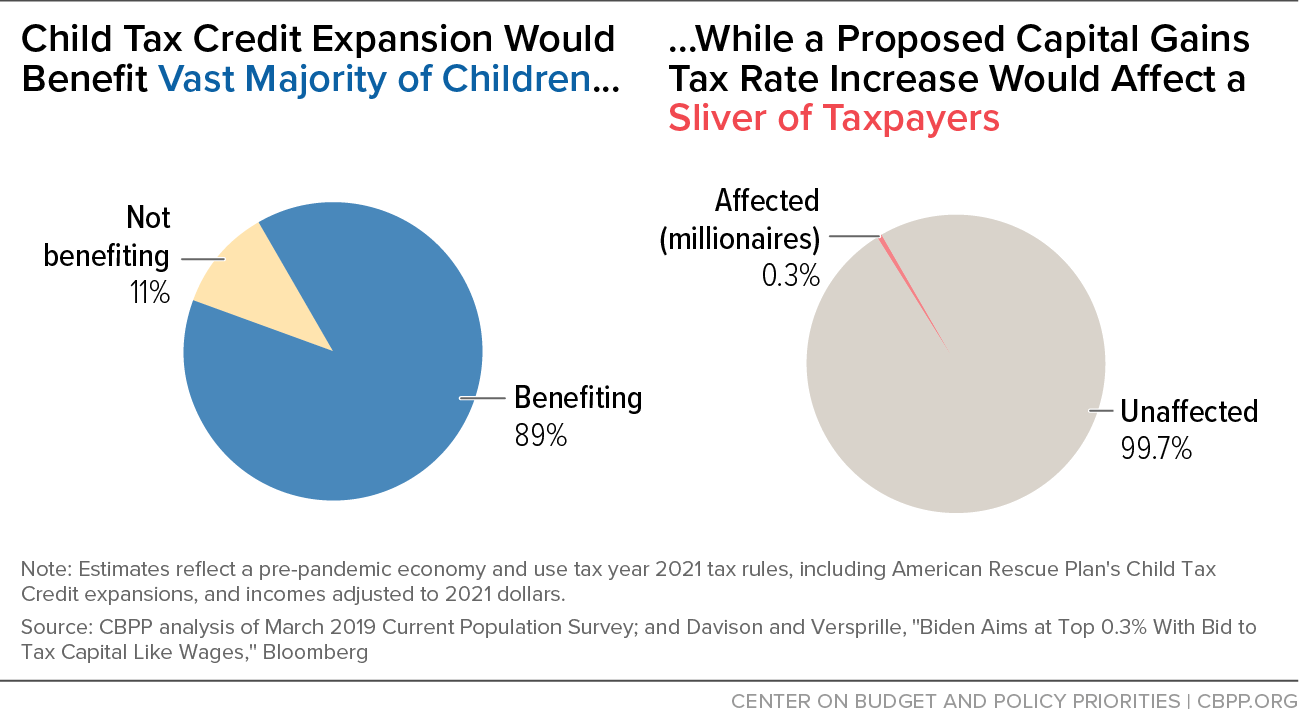

Calculating Return On Investment Roi In Excel

Investment Portfolio Tax Reporting Sharesight

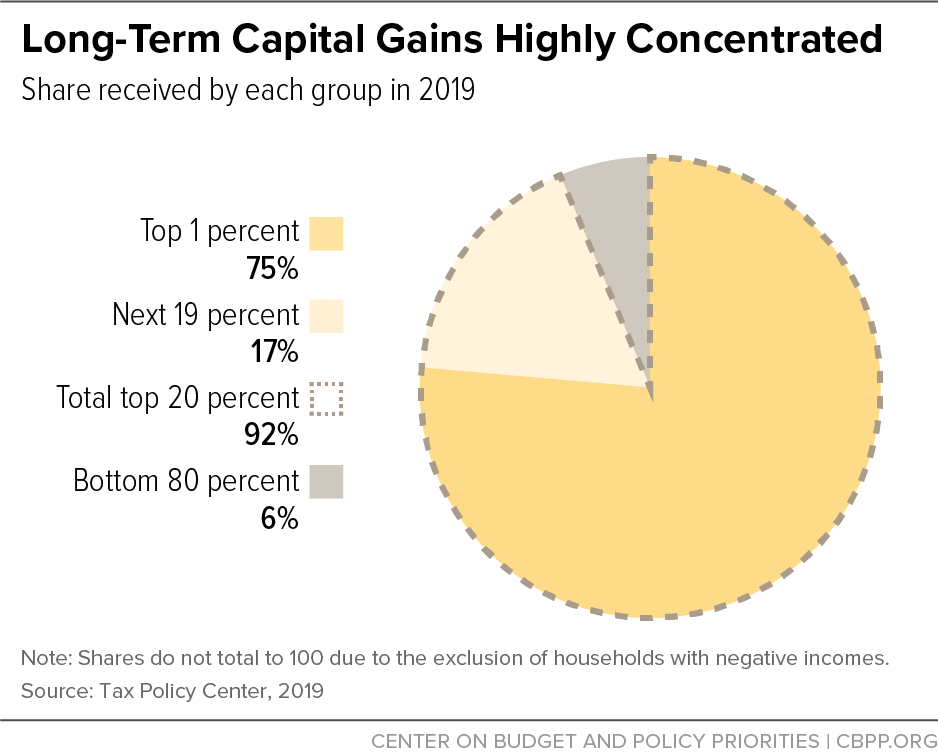

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

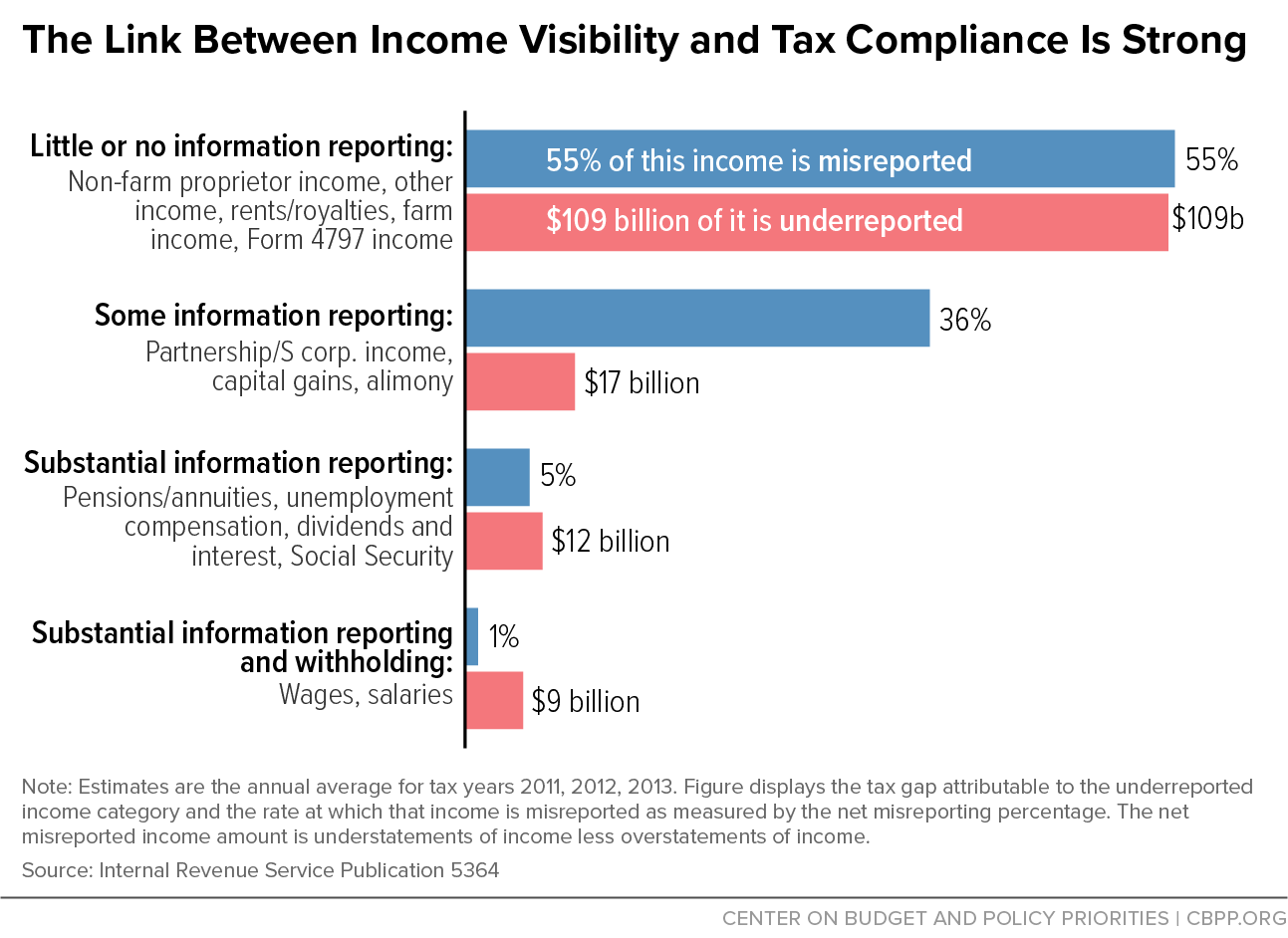

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

On Tax Day 9 Charts On The System S Inequities And Plans To Address Them Center On Budget And Policy Priorities

Taxation Of Income And Gains From Offshore Funds Deloitte Ireland Deloitte Private

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong