pay indiana unemployment tax online

This is lower than the long term average of 595 239 People Used More Info. Department of Labors Contacts for State UI Tax Information and Assistance.

When Can I File My Taxes For 2022 First Day To File Taxes

You can find your Indiana Tax ID number on notices received from the Indiana Department of Revenue.

. To establish your Indiana UI tax account youll need a federal employer identification number EIN. You can apply for an EIN at IRSgov. Enclose your check or money order made payable to the Indiana Department of Revenue.

Generally if you apply online you will receive your EIN immediately. Taxpayers may still be able to deduct some portion of their unemployment income on their state tax return in accordance with Indianas current tax laws. Write your Social Security number on the check or money order.

Employers paying by debit or credit card should authorize 9803595965 and 1264535957. Select a payment option. Bank Account Online ACH Debit or Credit Card American Express Discover.

Most employers pay both a Federal and a state unemployment tax. As most of you probably noticed last quarter the Indiana Department of Workforce Development changed the Uplink website and process for filing quarterly Indiana unemployment tax returns. Logon to Unemployment Tax Services.

You can claim a tax credit of up to 54 for state unemployment tax you. Pay the amount due on or before the installment due date. Employers with previous employees may be subject to a different rate.

As a result Indiana taxpayers cannot use the federal unemployment compensation exclusion on their 2020 Indiana individual income tax returns and that income must be added back in. I need to file my 2020 Indiana individual income tax return and plan to file electronically or prepare my tax return using tax softwareonline services. Take the renters deduction.

Have more time to file my taxes and I think I will owe the Department. Those who used tax preparation software or online services to file prepare returns for mail-in or file electronically should check to see that the company updated its software to add back unemployment. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

You also can file a wage report online or adjust a filed wage report online. Indiana Unemployment Rate is at 300 compared to 330 last month and 500 last year. All payments are processed immediately and the payment date is equal to the time you complete your transaction.

Rules for Unemployment Insurance Tax Liability. To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments from T356000158 are authorized for Indiana SUTA payments. You can also make your estimated tax payment online via INTIME at intimedoringov.

New Indiana Unemployment Website and UC-1 filing process. Online Payment Service by VPS. This must be completed for OnPay to be able to file and pay your Indiana taxes.

Overtime pay is not required for live-in employees. Indiana changed its unemployment compensation law in 2015. FUTA comes with one big caveat.

Indiana State Unemployment Tax Rate. You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers. All these changes were implemented by the department after receiving extensive user feedback.

For a list of state unemployment tax agencies visit the US. INtax only remains available to file and pay the following tax obligations until July 8 2022. Electronic Payment debit block information.

Indiana Tax ID Number. INTAX only remains available to file and pay special tax obligations until July 8 2022. In Indiana the new employer SUI state unemployment insurance rate is 250 percent on the first 9500 of wages for each employee.

Make payments by e-check and credit card The Uplink Employer Self Service System provides you with immediate access to services and information. They are the choices that get trusted and positively-reviewed by users. Only the employer pays FUTA tax.

Select the Payments tab from the My Home page. If you cannot locate this number please call the agency at 317-233-4016. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

This page aggregates the highly-rated recommendations for Pay Indiana Unemployment Tax Online. It is not deducted from the employees wages. Claim a gambling loss on my Indiana return.

If you are an employer with an existing SUTA account number be sure to check the Yes option button on the first screen you see after clicking New User on the ESS logon screen. Find Indiana tax forms. Unemployment Tax Payment Process.

Know when I will receive my tax refund. Please use the following steps in paying your unemployment taxes. All payments must be made with US.

For more information refer to the Instructions for Form 940. Unemployment Insurance is a program funded by employer contributions that pays benefits to workers who are unemployed through no fault of their ownPlease use our Quick Links or access on the images below for additional information. Pay FUTA unemployment taxes which is 6 of the first 7000 of each employees taxable income.

FUTA comes with one big caveat. This is an employer-only tax. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

Pay my tax bill in installments. This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD.

Expert Tax Filing Services Our Products Paylocity

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Indiana Form Uc 1 Updates Tax Alert Paylocity

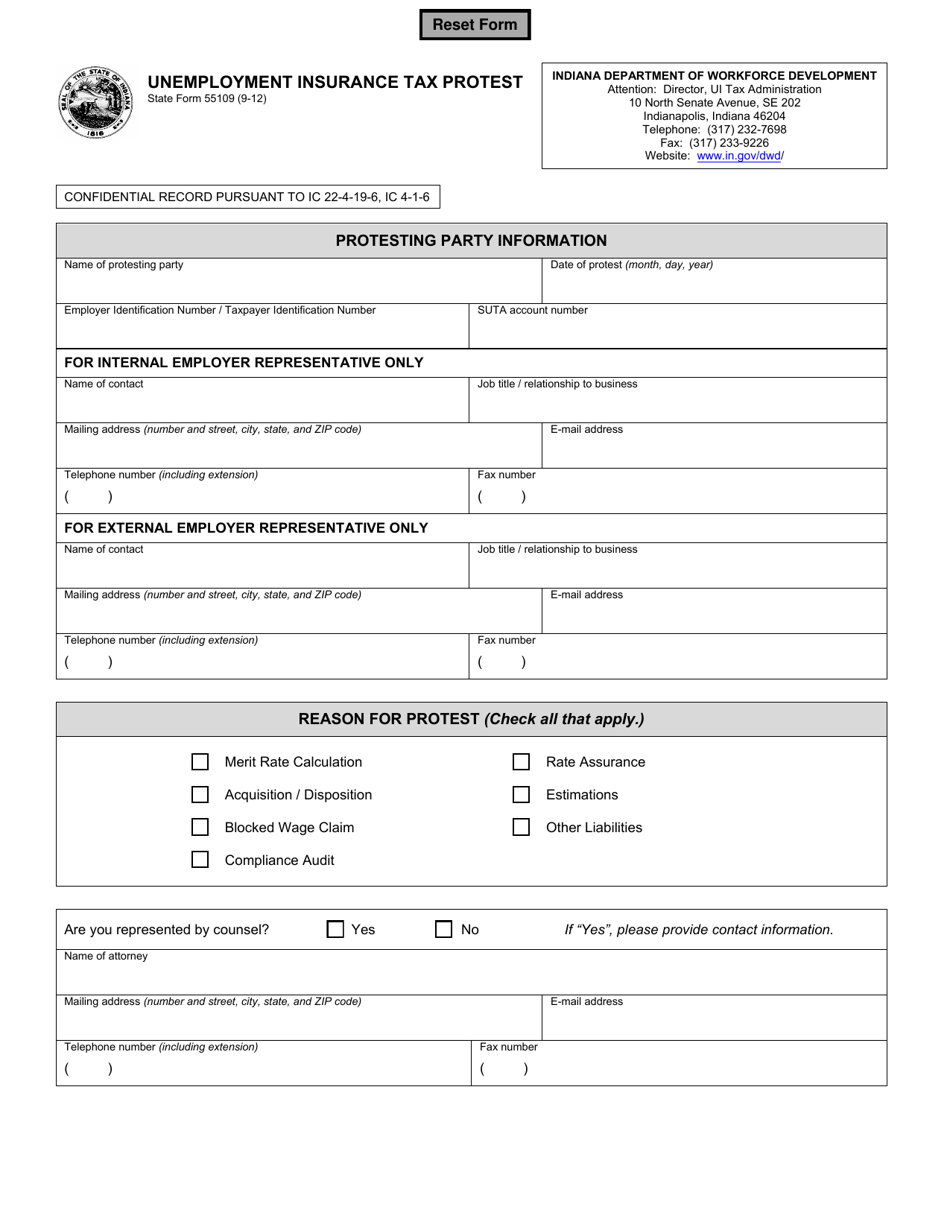

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

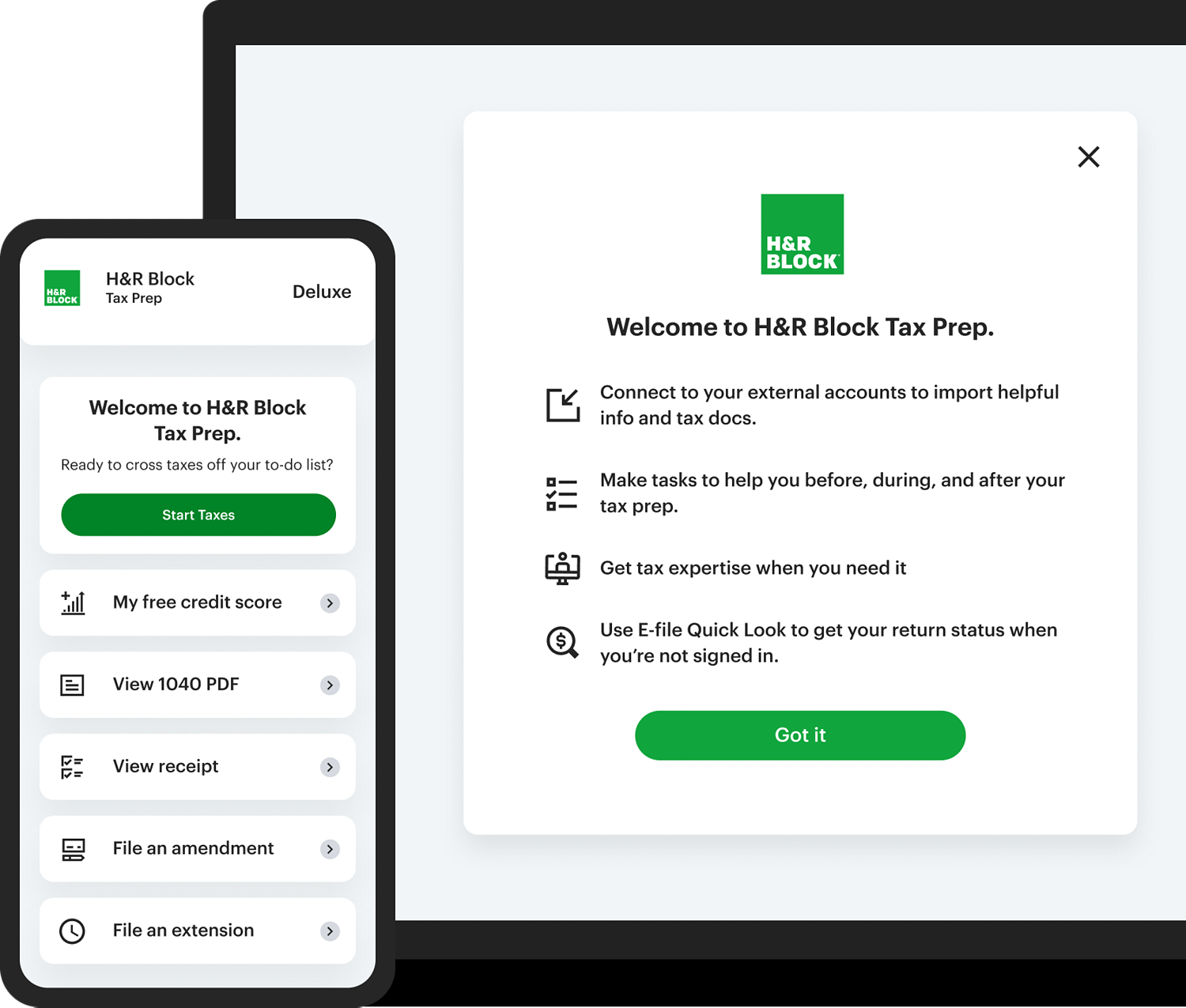

Deluxe Online Tax Filing E File Tax Prep H R Block

Do Seniors Have To File A Federal Tax Return 2021 As Com

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

How To File Taxes For Free In 2022 Money

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Filing For Unemployment Benefits In Illinois And Encountering Issues Try These Tips During The Coronavirus Crisis Abc7 Chicago

Most Indiana Individual Income Tax Forms Now Available Online Wrbi Radio

H R Block Review 2022 Pros And Cons

Ways To File Taxes For Free With H R Block H R Block Newsroom

Freetaxusa Review Pros Cons And Who Should Use It

Efile Review Pros Cons And Who Should Use It To File Taxes

It Has The Professionals To Provide The Services At Cheap Rate And Fast To Meet The Deadline Of The Payment Of Taxes Tax Attorney Tax Lawyer Tax Refund